The Fibonacci mystique in markets

LOKESHWARRI S K

The number sequence of Leonardo Fibonacci has an uncanny ability to influence financial markets. Lokeshwarri S K offers a peek into this wonderland

To a casual observer, the stock market would appear to be a blur of activity with stock prices reacting randomly to news flow and to the sudden bursts of emotion that seem to grip traders every now and then.

It is probably for this reason that the ‘random walk hypothesis’, first proposed by the French broker Jules Regnault in 1863 and later popularised by Burton Malkeil and Eugene Fama, found a loyal band of followers. This theory states that there are no discernible patterns in the stock market and hence the future moves cannot be predicted.

There are, however, a large group of economists, investors and analysts who believe that the study of past prices shows definite patterns that can be used to predict future trends. One of these price forecasting methods, widely used in equity, commodity, forex and other markets across the globe, uses the Fibonacci sequence, popularised by the Italian mathematician Leonardo Fibonacci.

The regularity with which the numbers and ratios in this sequence recur in price patterns in financial markets is astounding, making them a reliable guide in price projections. Here’s a glimpse of the influence wielded by these numbers.

The Fibonacci sequence

Born between 1,170 and 1,180, Leonardo Fibonacci, son of a merchant, probably lived in one of the towers of Pisa that served as workshops, fortresses and family residences. When his father was appointed a customs official, he accompanied him on his tours in the Mediterranean region, meeting merchants from various countries. After one of his travels, he wrote the book Liber Abaci in which he introduced the Fibonacci sequence to Italians through the rabbit problem.

It is believed that the number sequence that was published by Fibonacci was not new. A similar sequence had been written about in some Indian scriptures published decades earlier. But Fibonacci was the first to popularise the numbers in the Western world.

The rabbit problem mentioned in Liber Abaci goes thus — How many pairs of rabbits placed in an enclosed area can be produced in a single year from one pair of rabbits if each pair gives birth to a new pair starting with the second month?

The answer to the problem is 144, arrived through the sequence that shows the number of pairs at the end of each month,

1,1,2,3,5,8,13,21,34,55,89,144

Each successive number in this series is the sum of two preceding numbers. If we divide one number in the series by the number to the right of it, after the first four numbers or so, we get the ratio 0.618. If a number is divided by the number to its left, we get 1.618. The numbers 0.618 and 1.618 also form the golden ratio or the golden mean that is said to be pleasing to the eye and recurs frequently in music, art, architecture and nature. There are numerous other ratios and relationships that can be derived from this sequence, some of which will be discussed later.

There are many instances of the Fibonacci sequence and the golden ratio in natural phenomena, including the seed curves on the sunflower, arrangement in pine cones, petals in flowers, branches in a tree, sub-division of the human body and so on.

So how are these numbers connected to stock and other markets? Since stock markets are a manifestation of the actions of a group of men, it is basically the behaviour of humans that determines stock market movement.

Frost and Prechter, in their epic book, The Elliott Wave Principle, write, “This truth suggests that men’s emotions, in their mass expression are keyed to the laws of nature.” It is therefore not surprising that the Fibonacci numbers wield influence on stock markets too.

Fibonacci retracement

Getting down to the practical application of the Fibonacci numbers, if the stock market is correcting and you are wondering where the price decline can halt, you can use Fibonacci retracement levels. Similarly, if the price is beginning to move higher after a decline, these retracement levels can indicate the extent of the up-move.

We looked at two ratios, 0.618 and 1.618, which can be derived by dividing a number by the numbers adjacent to it. If a number in the sequence is divided by a number one place away to its right, we get the ratio 0.382, on dividing by a number two places away, we get the ratio 0.236.

The Fibonacci retracement levels are based on these ratios — 0.236, 0.382, 0.618. 0.55 is added in between, perhaps because 55 is a Fibonacci number and the half-way mark is always a significant support or resistance. I have found the 0.382 and the 0.618 ratios most effective. A downward correction that halts at 0.382 implies that the uptrend has strength while a fall that goes below 0.618 implies that the bears have taken over.

To calculate the retracement, the previous move is measured and multiplied by the ratios. The values are deducted from the recent peak to derive levels where price decline can halt or added to lows to derive levels where rallies can end. These retracement levels are equally effective along all time frames: intra-day, daily, weekly, monthly or quarterly.

Take, for instance, the US dollar index chart. It has been in a structural decline since 2001, as the global economy went into an expansionary phase, beginning a long-term rally in most stock markets. The dollar index fell from the 2001 peak of 121 to bottom at 71 in 2008. A rally has been in progress since 2008, but it has halted at 0.618 retracement of the previous down-move that occurs at 102. The struggle of this index to surpass the zone around 100 is partially due to the retracement hurdle in the vicinity.

Since these levels are very popular and many investors and traders are watching them, they tend to be self-fulfilling.

The 0.618 per cent retracement has also come to the aid of the Sensex many times in severe declines. The fall in 2008 in the Sensex halted slightly below the 0.618 retracement of the up-move from April 2003 to January 2008. But the decline in 2015 halted around the 0.618 retracement of its previous move.

The retracements can be applied to stocks too. The stock of Axis Bank has been holding above the 0.618 per cent retracement on its long-term chart, which is at ₹345 over the last two years, showing that the stock still holds promise.

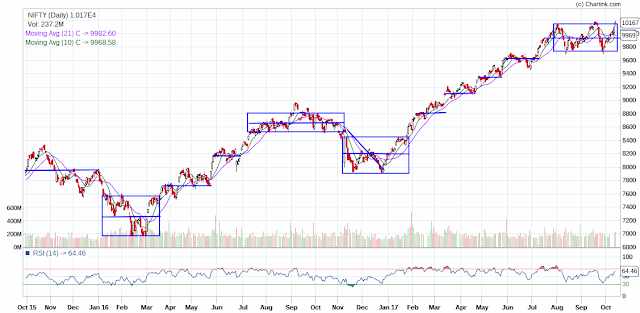

Projection: If we attempt to apply the retracement tools to the weekly chart of Nifty, it will tell the extent to which the current decline can extend. The up-move preceding the current correction began at the December 2016 low and ended on August 4 this year. If we retrace this move, we get the likely targets of this fall at 9634 (0.236), 9,307 (0.382), 9,039 (0.5) and 8,771 (0.618). Since we are in a strong uptrend, the support at 0.382 level of 9,307 is critical.

Fibonacci extensions

When the price reverses direction, Fibonacci retracements are useful to project the extent of the next move but when price trends in the same direction, Fibonacci extensions are useful. Here the ratios derived by dividing a number in the Fibonacci sequence by a number to its left are also used. The ratios used for extensions are 0.618, 1.000, 1.618, 2.618 and 4.235.

Since recent history is etched in the mind more clearly, the magnitude of moves is related to their preceding moves. For instance, in an up-move, if there is a brief pull-back, the extension ratios can be multiplied by the magnitude of the previous up-move and added to the end of the corrective wave to project the next move higher. Similarly, if the trend is down, the extension should be deducted from the end of the short-term pull-backs.

For instance, if we consider the weekly chart of DAX, the German benchmark index, one leg of an up-move was completed between January and August 2016. If we tried to project the next leg of the up-move using Fibonacci extensions, the targets were 11383 (0.618), 11990 (1.000) and 12,971 (1.618). The DAX made the peak at 12,921 in June this year and has reversed.

Projection: If we apply the extension rules to the Nifty weekly chart, the previous up-move lasted between March and September 2016 and resulted in a gain of 2,144 points. If we use this as an extension from the December 2016 low, we get the targets of 9217 (0.618), 10,037 (1.000) and 11,361 (1.618). The Nifty has achieved the second target and is currently pausing. If the up-move continues, the third target will be in the reckoning.

Relation with Elliott Wave Theory

The examples cited above use Fibonacci numbers and ratios in the most basic manner. The best way to use these ratios is in conjunction with Elliott Wave Analysis. R N Elliott believed that the stock market, like everything else in nature, has a form and no matter how minute or how large the form, the basic design remains the same. He laid down that market moves in up-moves made of 5 waves and down-moves made of 3 waves. The structure is the same, be it in a one-minute chart or a multi-year chart. The waves of Elliott are related to each other with Fibonacci ratios and the two work wonders when used in conjunction.

Using fans and arcs

There are some lesser known and less widely used tools such as the Fibonacci fans and arcs that can also be used effectively by traders and analysts. These tools bring in time as well as price projections. Most technical analysis software provide tools to draw these lines.

The Fibonacci fan is a three-line tool that uses the ratios .382, .50 and .618. To draw the Fibonacci fan, a trend line is drawn from the nearest peak to trough or vice versa. The vertical distance between a peak and trough is multiplied by the ratios .382, .50 and .618 and deducted from the peak or added to the trough where the trend-line ends.

Then three lines are drawn from the leftmost point in the trend line to intercept the vertical line at the three levels derived by the ratios. What we get is a Fibonacci fan with three lines.

Following a down-trend, these fans move down from the peak, thus providing resistance levels for the following up-move.

After an uptrend, the fans would fan upward, providing support levels for the next down-move.

Another visually pleasing way of utilising the ratios to derive supports and resistances is by drawing the Fibonacci arcs. The initial steps for drawing the arc are similar to that for drawing the Fibonacci fan. The ratios are multiplied with the vertical distance between a peak and a trough. Then arcs are drawn through these levels.

The major drawback with these tools is that they tend to lose their relevance in a prolonged sideways move. Secondly, since they are less used, they do not enjoy the psychological advantage that the Fibonacci retracement has.

Timing market reversals

Wouldn’t it be wonderful to know in advance if a market reversal is around the corner? Fibonacci time series is one of the tools available to project the time market moves can take. This tool hasn’t gained in popularity since it can be used mainly on the long-term horizon and traders in futures market do not really care about what happens beyond one day.

Fibonacci time-lines are fairly easy to draw on any technical analysis software. The first step is to identify a major trough or a peak. This will be the point where the first line will be drawn. Subsequent lines are drawn at intervals corresponding to the numbers in the Fibonacci series, 1, 2, 3, 5, 8, 13 and so on. The sessions that fall on any of these lines are likely to be reversal points for a move.

It would be best to draw the lines on weekly chart of benchmark indices. If we draw the Fibonacci time line from March 6, 2009, on the weekly chart of Sensex, the findings are quite astonishing. The 34-week line is at November 2010, where the first peak was formed. The 55-week line is at the significant bottom of November 2011 and the 89-week line is very close to the August 2013-low where the current bull market began. Since the number of weeks increases down the series, the next line according to this series is in Q1 of 2019.

If we draw a Fibonacci time series from the March 2016 low, the next line occurs seven weeks from now, or in November. That sets the stage for the possibility of a sharper fall towards the end of this year.

Others have also tried to plot long-term cycles in stock markets. Samuel T Benner, a wheat farmer, framed multi-year cycles for markets using cycles in pig iron prices in 1875. He found that highs of cycles followed 8-9-10 pattern and lows followed 16-18-20 pattern. A J Frost applied this cycle to Dow Jones to predict the next 10 years quite successfully in 1965. The book, Elliott Wave Principle, stops with projecting Benner’s cycle upto 1987.

We tried to project it further and found that the 2000-peak and 2010-peak were identified by this cycle but the 2008 decline was not captured properly. The next peak, according to this cycle, is 2018 that could be followed by a multi-year down-trend.

Another method employs Fibonacci ratios. This is done by multiplying the number of sessions that a move has consumed by the different ratios — 0.236, 0.382, 0.618, 1 and 1.618 and adding it to the ending point of the move to arrive at the time that the next up or down move can be spread over.

http://premium.thehindubusinessline.com/portfolio/big-story/the-fibonacci-mystique-in-markets/article9882845.ece